PropSoch Acquisition

Acquisition Channels - Strategy and Experiments

Product

Product: PropSoch

Product stage: pre-PMF, tech enabled.

Industry: Residential real estate

Core value proposition: Help homebuyers find a home that meets their needs and take an informed decision backed by detailed insights and expert advice.

Geography: Bengaluru

Average order Value: 5 lakhs INR (~5% of property purchase value, avg purchase value 1Cr)

Product Flow

https://whimsical.com/propsoch-flow-PbYGU4V7LtE4PpK4ecLULs

What are people saying about PropSoch on Google reviews?

- systematic approach

- contemplate criteria that you might not have previously considered

- transformed the buying process

- understand my needs and non-negotiables

- informed decision

- non-pushy

- which made me feel comfortable and confident in my decision.

- professional and reliable advisory services in the real estate industry.

- protected our contacts saving us from spamming from marketers.

- also offered to help us with negotiations and architectural screening.

- detailed Excel sheet just to shortlist properties was outstanding

- professional and structured in their approach

- insights were mind-blowing! They didn't just show me places, but explained WHY some were good and others not so much, which was a huge deal for me coz I'm no real estate expert. They talked about future developments, potential risks, and all those things, making sure I knew exactly what I was getting into.

- It was not just like working with a consultant, but more like a partner who really cared bout my investment.

- They took care of all the paperwork and legal stuff too which was a big relief!

- report/analysis was not biased in any direction which gave us even more confidence to draw a conclusion and decide — unbiased opinion

- As a NRI, buying a property back home is a really challenging task. The distance and limited information about the local market can lead to frustration, uncertainty and consume a lot of time. their scientific and research-based approach to homebuying gave us a lot of comfort and solved our biggest pain point.

- fastest decision and investment ever made!!

- genuine help

- We found Ashish and Propsoch through a mutual friend of ours

- varied perspectives (legal, stakeholder-specifc {developer/buyer}, location, price, amenities, etc.,)

- We would have never been able to consider all the factors they had brought up by any amount of Googling / brochure browsing.

- Decision fatigue, availability bias and advertising gimmicks kick in, and its hard for homebuyers to make an informed choice. Having a neutral third party like Propsoch who does not want to sell you a property and gives you their unbiased feedback is a must have.

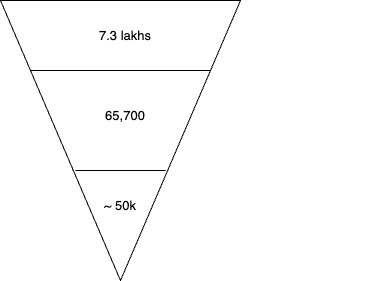

TAM, SAM, SOM

TAM

TAM is the total number of homebuyers in India.

India’s population: 1.4 billion

Only a % of total population will have a use case for buying a house.

Assuming this would be people > 30 years,

i.e. 50% of 1.4 billion = 700 million Source

Out of these 700 million people, only those in urban cities have access to residential projects.

i.e. ~ 35% population in urban cities. [(urban population)/(urban + rural population)]

35% of 700 million = 245 million

Now, not every person may buy a house, considering most of the people in this age group are married. Sex ratio in India is approximately a 1:1 ratio. i.e., a 50-50 share of male-female population.

So, the TAM is half of 245 million = 122.5 million households.

Current TAM

Let’s say this will be a % of TAM who:

- Do not own a house till now.

- Have annual household income > 35 lakhs.

According to Source, 31% population do not yet own houses.

To calculate for households (2 people buying house together), lets approximate this to 20%.

20% of 122.5 million households = 24.5 million households

And 12% households have annual family income > 35 lakhs.

Source: page 5 in PDF

ANAROCK_Consumer_Sentiment_Survey_H1_2023_e1f41912a5.pdf

12% of 24.5 million = 2.94 million households is our current TAM.

Assuming 1 household = 1 house unit,

current TAM = 2.94 million house units.

SAM

SAM is dependent on factors like:

- Supply and demand

- Price of houses

- City

Breakdown of total units available in the market

*PAN India includes tier 1 cities

Source:

Q3_2023_PAN_India_Residential_Market_Viewpoints_643b1c3a74.pdfSAM = Units x Avg house price x PropSoch’s share from builder

50k x 1 Cr x 5% = 2500 Cr SAM

SOM

SOM is how many units are sold in the market and out of that, how many we can obtain, keeping competitors in mind.

Competitors

PropSoch competitors.pdfRevenue potential = Sold units x % of units above 80 lakhs x Avg house price x PropSoch market share x PropSoch share from builders

- House units sold = 16400 [Source: Q3_2023_Pan_India_Residential_Market_Viewpoints PDF shared in previous section]

- Assuming 60% of these units sold > 85 lakhs budget

- Taking average house price = 1 Cr

- Considering our competitors have a large market share already and have the resources to grow faster, let's at least try to capture 1% of the market to start with.

- PropSoch's share from builders for every house purchase = 5%

So, our SOM calculation will be as follows:

16400 x 0.6 x 1 Cr x 0.01 x 0.05 = 4 Cr

Insights for channel decision

PropSoch discovery

- Knew founder from before. Looks up to founder as someone with deep knowledge and great experience in Real Estate Industry.

If PropSoch didn’t exist, they would have:

- Looked at newspaper ads for info on new building properties.

- Gone with a known builder name.

- Made an impulsive choice based on what the builder’s sales guy told them.

- Taken the help of brokers to find properties in specific locations.

- Done their own online research - Google search, looked at sites like 99 acres, housing, etc.

- After a point of searching on Google, they would have started seeing relevant ads on Insta. Since this is a visual decision, seeing images of the properties + price details would have been more enticing than Google search ads which is more of a text-based format.

What did they love the most about buying a house with the help of PropSoch:

- They were forced to think about parameters they didn't even know existed. Before they didn't know that "waterbody facing apartment" could be a parameter. Today they have bought a house that's facing a waterbody in a good developing locality.

- Structured and detailed approach to prioritizing what matters and then buying a house.

- They were able to change their POV by following a process and this made them feel more confident about the purchase because they knew that they had evaluated everything necessary, from all angles, and arrived at their decision.

- Would definitely recommend PropSoch to a friend/family member.

Repeated feedback

- User had no idea where to look or what to do during homebuying journey. That's when a friend recommended PropSoch to him and it was just the right thing he needed at that time. He would have probably not come to PropSoch to buy a report if he already had a property/project in mind.

- Many users mentioned that they were a little hesitant to pay 10k for a report. But having gone through the experience, they feel that the overall process that they went through along with advisory help and insights was totally worth the price.

Channel 1: LinkedIn Newsletters (Organic)

Insights

- Based on google search of relevant keywords, it’s clear that this is a highly competing space for Google ads or even SEO.

- Search volume of use case queries is high but the 1st 4 results for most of these searches are just sponsored ads.

- So, even if we put in the efforts to rank on page 1 organically, it’ll not only take a long time but also be somewhere below 5th or 6th result for the use case keywords.

- Competing for use case or competitor keywords at this point would prove to be an expensive affair.

- Use case topic keywords have relatively lower search volume, so even though it might be slightly easier to rank for these keywords, the effort is too high vs ROI.

- However, when we look at the “People also ask” questions, we see that there is an interest in use case topics like “What is the best builder in Bangalore to buy a flat?”, “Is it good to buy a flat in Bangalore?”. These are being discussed in forums like Reddit, Quora. And some players have even created articles in their blogs to address these topics. Refer

Hypotheses

- To test out the need for such content, we can experiment by creating content on LinkedIn - a platform that takes care of the SEO aspect of the article + gives access to reach a big audience from day 1.

- People already look up to Ashish (founder of PropSoch) as an expert in Real Estate. He has 12+ years experience in this field. Leveraging his credibility and network on LinkedIn gives a slight edge over over other organic channels for content creation.

Is this a good channel to experiment at this point?

Cost | Zero |

Effort | High - need to produce high quality content consistently. |

Time to see results | Quick |

Feedback indicators | For every case study published, we can monitor and learn from metrics movement. |

Implementation plan

Create case studies that address relevant questions homebuyers have in mind before buying a house.

From Ashish’s (PropSoch founder) LinkedIn, create LinkedIn newsletters that address relevant questions homebuyers have in mind before buying a house.

Make the post engaging and treat it like a hook for the full article published in Linkedin’s newsletter.

-------

👉 Example topics

What is the best builder in Bangalore to buy a flat?

Is it good to buy a flat in Bangalore?

-------

https://whimsical.com/linkedin-implementation-EpECcktozJ5jXR3wUnYB51

Success indicators

#. of leads = Reach x CTR x Website visits

Secondary metrics to monitor and understand which distribution channels are working vs not.

Depth of engagement (likes, views, shares, comments) on distribution channels

#. of newsletter subscribers

#. of followers on distribution channels

Channel 2: Insta and FB ads (Paid ads)

Insights

- People resort to Google for online research to find properties. They search for things like 3bhk villa in whitefield, buy villas in bangalore, etc.

- However, this channel has high competition and is expensive to use as an acquisition channel at this stage.

- That said, ICPs don’t seem to be liking this channel for property discovery. Mainly because they are not able to find properties that match all or most of their requirements.

- Also, ads on Google are more text-based and every ad looks pretty much the same. People want to avoid clicking on these click-baity links because most times, the destination site doesn’t end up fulfilling their needs. Or they perceive ads as shady and skip.

- After some time, this audience starts seeing relevant sponsored ads on Insta which seem to catch their attention more because - Insta is a visual medium and buying a house is a visual choice. Seeing images of the property along with info of price makes them want to click and check out the property.

Hypotheses

- Because Google ads space is quite crowded, people are getting lost and more confused about their homebuying decision.

- They’re desperate to find someone who can just understand their requirements and provide legit recommendations to them. There’s a slight sense of hopelessness about finding the right house all by themselves.

- At this stage, if we’re able to target them and address their pain point, they’d be more willing to check us out.

- We can run ad campaigns on insta (can experiement this with FB also) that target users who’ve visited competitor sites on google, and show them how PropSoch can solve their problem with a buyer-centric video.

Is this a good channel to experiment at this point?

Cost | Medium - need to evaluate this deeper. Spends would include video production cost, ad budget. |

Effort | Medium - one time video creation that can be reused in multiple campaigns. |

Time to see results | Quick |

Feedback indicators | On a daily/weekly basis we can monitor conversions from ad to website. And further look at conversions of website visitors to sign up. |

Implementation plan

Create targeted videos addressing the biggest value for each ICP.

P1: ICP 2 and ICP 4 first (refer ICP Prioritization inside ICPs section)

P2: ICP 1 and ICP 3

Ad storyline | |

ICP 2 - NRI | Came to India for 1 month to find and buy home for investment purpose. Spoke to some friends who connected him to brokers to fasten his property hunt. But that didn’t help much, they weren’t showing good properties and felt like their opinions were biased toward pushing him to close a deal. |

ICP 4 - Uncompromising | Tried finding homes from property listing sites but couldn’t find good projects. The known builders he trusted weren’t building projects in his desired locations. Was not sure how or where to find projects that matched his requirements. |

ICP 1 - Self-reliant | Had spent over 6 months researching by self and looking at over 20 projects in Bengaluru. Had shortlisted it 3-4 properties, but still wasn’t sure which would be the best one to buy. Needed help in analyzing all the pros and cons before taking a decision. |

ICP 3 - Skeptical | Had bought a property from a known builder before, but the property never got delivered. Didn’t want to be fooled again. Needed help with due diligence to get complete assurance of delivery time. |

Success indicators

#. of leads

Conversion rate

Channel 3: Referral

Insights

- Most people are getting to know about PropSoch today via WOM discovery.

- Every user who has gone through the experience so far has given a 5/5 rating when asked whether they're willing to recommend PropSoch to a friend/family.

Is this a good channel to experiment at this point?

Cost | Low |

Effort | Medium - one-time effort of creating communications for the entire journey + recurring effort of triggering the communications |

Time to see results | Medium - 3 to 4 weeks |

Feedback indicators | Understanding value of report for users by talking to them |

Brag-worthy thing about product

Buying a dream house and feeling confident about the decision.

Platform currency

Access to services and/or insights

Who and when to ask?

When a user receives a report and sees the detailed insights for a property, they experience an AHA moment. At this point, take a survey to understand whether:

A. they liked the report.

B. they would like to recommend PropSoch to a friend/family member who is looking to buy a home.

Validation to ask for referral: Answered yes to both questions

Referral flow

How will users discover referral program?

Send users a WhatsApp message along with an image introducing them to the referral program. And also share a form through which they can submit referee contact details.

How will users track referral completions?

We will send a message to the referrer about referee status at relevant intervention points.

There could be 3 cases:

Case 1: Referee is actively moving in the Referee flow shown above.

Case 2: Referee not aligned for discovery call.

Case 3: Referee not paid for report.

For all 3 cases, design communication journey that can be shared to referrer about their referral status.

Another experiment (little later stage): Create landing page to help users track referral status like how we track FedX or other deliveries with the help of a tracking ID or link.

Channel 4: Ads in IT parks

Insights

- ICPs comprise of people working in high-paying jobs.

- Their office is usually in IT parks. Some in stand-alone buildings. And remaining work remote.

Hypotheses

- For those who go to office regularly, we could try placing our ads in strategic locations such as elevators, elevator TVs, food courts, notice boards, etc. This could increase probability of discovery for Propsoch.

- Say, this experiment costs 50k per month, even if we acquire 5 leads from this channel, it’ll prove to be a positive ROI channel.Revenue from report per user: 10k - 15kRevenue from property closure: 5L

Is this a good channel to experiment at this point?

Cost | Medium-low |

Effort | Medium: ad creation + aligning IT parks for advertising |

Time to see results | Depends on the feedback indicators |

Feedback indicators | Are people reaching out to PropSoch after looking at the ad? |

Does it require personal intervention for faster results?

Monthly ROI |

Implementation

➡️ Align for advertising in top IT parks where footfall is high.

➡️ Choose 3 IT parks where potential to acquire leads is high and fits within 30-50k budget.

➡️ Prepare ads based on the formats possible: Posters, kiosk, elevator TVs.

➡️ Run experiment and monitor ROI

➡️ Repeat in 10-15 parks with highest potential to acquire leads.

➡️ Decide whether to scale or kill this channel based on ROI.

Success indicators

ROI: Spends vs Revenue

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore foundations by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Crack a new job or a promotion with the ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.